Neuronetics: A Magnetic Future in Mental Health

Setting a new standard in mental health care

Overview

Neuronetics STIM 0.00%↑ is at the leading edge of mental health technology. Their NeuroStar TMS system and recent expansion into Spravato therapy are raising the standard for treatment of chronic mental health disorders. Neuronetics is positioned for strong growth as demand for mental health treatments surges. Despite accelerating regulatory momentum, solid competitive advantages, and a leadership team with strong execution, the stock remains overlooked.

TLDR

Neuronetics’ TMS therapy offers a safer, more effective, non-drug alternative for depression with higher remission rates and minimal side effects compared to antidepressants.

Low awareness of TMS has limited its rate of adoption, but growing bipartisan support for non-pharma treatments and a regulatory shift under Trump/RFK Jr. could accelerate approvals and payer coverage.

NeuroStar has first-mover advantage in key indications (e.g. adolescent depression), stronger clinical evidence, and practice support, giving it an edge over competitors. Their recent vertical integration of Greenbrook adds further scale and unlocks new revenue streams.

Despite improving fundamentals, management’s conservative guidance and limited analyst coverage have kept the stock undervalued, creating a rare opportunity to enter ahead of broader market recognition.

Neuronetics: The Essentials

Company Description

Neuronetics is a commercial-stage medical technology company specializing in non-invasive treatments for psychiatric disorders, notably through its NeuroStar Advanced Therapy System, which is used in the treatment of major depressive disorder (MDD).

Quick History

Neuronetics was founded in 2003. NeuroStar was its flagship product and received FDA clearance in 2008 for treating MDD in patients unresponsive to medication. The company went public in 2018 and raised $93.5 million. Today, Neuronetics has a presence in over 1100 practices across the U.S., having delivered over 6.9 million treatments.

Business Model

Neuronetics’ revenue is driven by a razor-and-blade model. They sell and lease systems to psychiatric and medical practices, and they receive recurring treatment session fees.

Thus, a key part of the company’s strategy is driving adoption and utilization of NeuroStar systems by supporting healthcare providers with marketing, training, and patient engagement tools.

Quick Primer on TMS Therapy

Indications (Approved Uses)

TMS is primarily used for treating major depressive disorder, particularly in patients who do not respond to medication (treatment-resistant depression). NeuroStar TMS is also cleared by the FDA for treating obsessive compulsive disorder (OCD), anxious depression, and adolescent depression.

TMS has also shown promise in conditions like post-traumatic stress disorder (PTSD) and chronic pain syndromes. There is also evidence of its potential in rehabilitation for stroke recovery, schizophrenia, and neurodegenerative diseases like Parkinson’s and Alzheimer’s. Additionally, TMS is being investigated for cognitive enhancement and addiction treatment.

How TMS Works

TMS uses an electromagnetic coil on the scalp to create a potent but brief (microseconds) magnetic field. This magnetic field enters the surface of the brain without interference from the skin, muscle, and bone. In the brain, the magnetic pulse encounters nerve cells and induces electrical current to flow in the brain.

Safety Profile

TMS is the most popular of novel brain stimulation techniques, particularly because it is non-invasive and has a strong safety profile:

TMS does not require a craniotomy (a surgical opening into the skull), induction of a seizure, or even anesthesia.

Its side effects are minimal, usually limited to a headache or scalp discomfort.

The risk of a seizure occurring from TMS is very low (an estimated 1 in 30,000 treatments), which is less than or comparable to the risk of seizures associated with antidepressants.

Now onto the interesting stuff…

Why an Opportunity Exists Here

Low Awareness of TMS Therapy

Neuronetics faced challenges in monetizing its technology in the past because of low awareness of TMS therapy as an option for treating MDD. Patients had a difficult experience in locating a psychiatrist offering insurance-covered TMS. Psychiatrists themselves were unable to communicate clearly about TMS and often did not answer phone calls to schedule appointments; and patients often forgot what TMS is when a physician would call in response to an inquiry.

In a 2020 study conducted in China, only 72.6% of psychiatrists knew that TMS was approved by the FDA for treatment-resistant depression; and only half of psychiatrists were familiar with the indications of TMS. In a 2024 study of individuals with depression in the U.S., only 12% of participants had previous knowledge of TMS. Furthermore, participants indicated that a lack of knowledge of TMS was a barrier to seeking TMS as a treatment option.

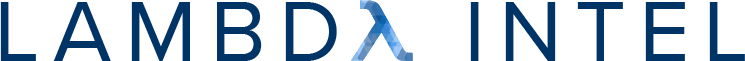

The limited awareness and slow adoption of TMS mirrors the early challenges faced by other medical breakthroughs.

Continuous glucose monitors (CGMs) were introduced in the early 2000s but initially experienced slow adoption like TMS, due to a lack of insurance coverage and physician unfamiliarity. In 2017, insurance companies and Medicare expanded coverage for CGMs, driving mainstream adoption. Now, the CGM is the standard for diabetes management.

Likewise, MRI technology was initially met with resistance. Many doctors viewed it as an unnecessary alternative to X-rays and CT scans. Insurance companies were reluctant to cover the cost, which slowed hospital adoption and limited patient access. But as its advantages in diagnosing soft tissue injuries, brain disorders, and tumors became clear, MRI scans became the standard for medical imaging.

A similar pattern emerged with GLP-1 receptor agonists, which were first identified in the 1990s for their ability to regulate blood sugar and appetite. In 2005, the FDA approved the first GLP-1 based medication for type 2 diabetes management. In 2014, a GLP-1 drug was approved specifically for weight management, but widespread adoption was still slow. It wasn’t until 2021, when semaglutide received FDA approval for chronic weight management, that GLP-1 medications saw mainstream adoption, driven by strong clinical trial results and patient interest.

In each of these cases, once the medical technology reached widespread use, the companies behind them saw stock returns far outpacing the S&P 500. This historical trend suggests that as TMS gains broader acceptance and insurance coverage expands, it too could experience a similar trajectory.

Cyclical Trough in Healthcare

From 2021 to the end of 2024, factors such as a focus on AI and rising interest rates shifted investment away from medical technology and the broader healthcare sector. As a result, the iShares U.S. Medical Devices ETF (IHI) underperformed SPX by 38.73%. The entire sector was beaten down indiscriminately, creating opportunities for undervalued stocks. The market has been slow to respond to improving fundamentals for overlooked stocks like Neuronetics with little to no analyst coverage.

NeuroStar Shines Bright Among Competitors

Compared to Antidepressant Drugs…

TMS offers a non-invasive, drug-free alternative to traditional medication. TMS provides targeted brain stimulation, whereas antidepressants may take weeks to work and rely on trial-and-error for proper dosing. TMS targets the regions of the brain specifically involved in mood regulation, whereas antidepressants work through systemic effects that indirectly affect brain chemistry. TMS does not cause common antidepressant side effects like weight gain, drowsiness, or sexual dysfunction. Additionally, TMS shows greater response and remission rates compared to antidepressants.

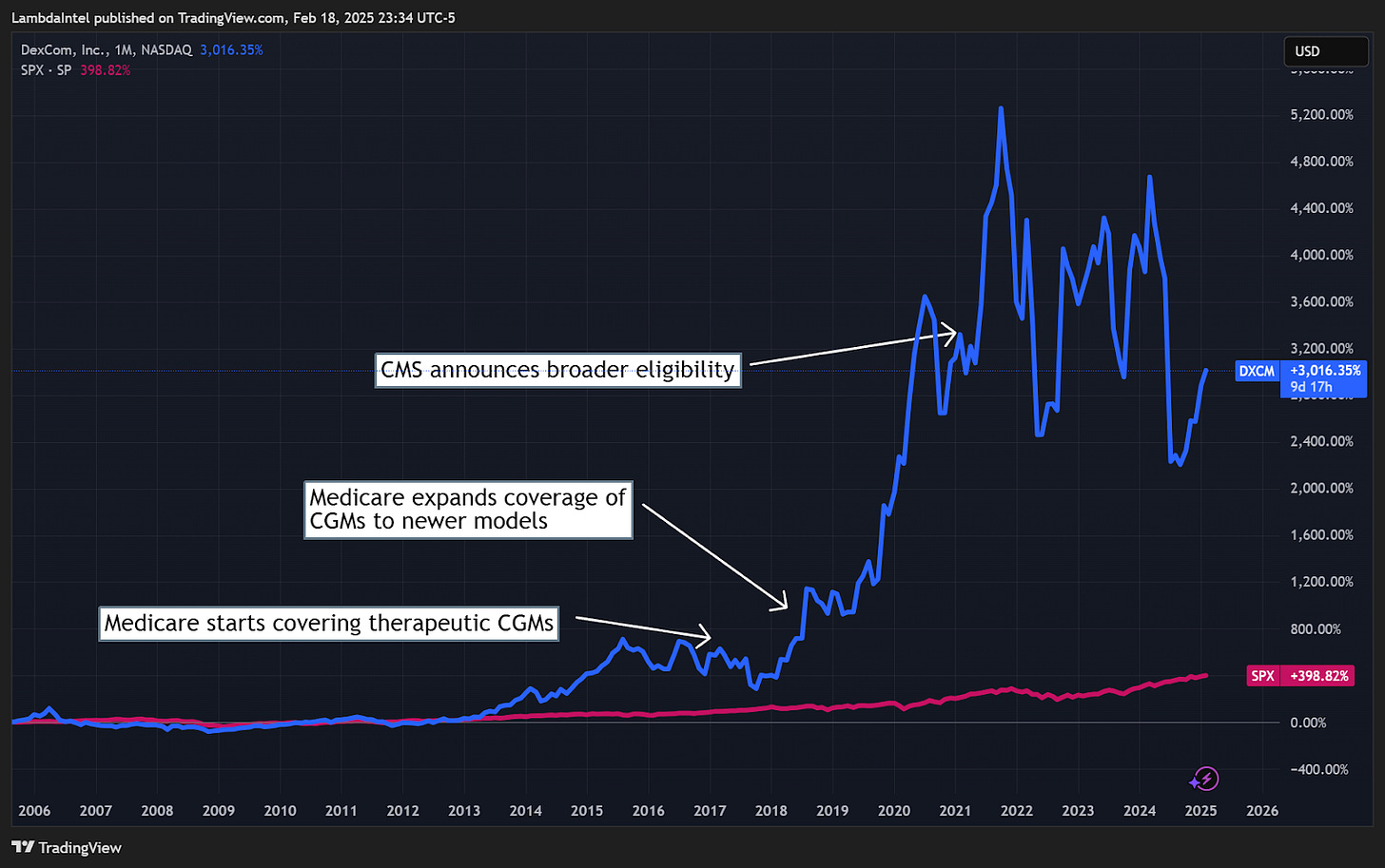

A 2021 study found that 42-53% of patients respond to antidepressant treatment. In the well-known STAR*D study, a third of patients reached remission using the SSRI citalopram, with another 10-15% experiencing a reduction in symptom severity. Similarly, In a 2001 meta-analysis, the British Journal of Psychiatry found that 45% of patients reached remission using the SNRI Effexor (with 25% of patients with placebo reaching remission).

Neurostar TMS outperforms both SSRIs and SNRIs, the two most popular classes of antidepressant drugs. Studies show that 62% of NeuroStar TMS patients achieve remission and 83% in total experience improvement in depression symptoms. Because of its effectiveness and minimal side effects, TMS is a promising alternative to antidepressants.

Here are some positive experiences described by TMS patients in the /r/TMSTherapy Subreddit. A common theme among patients is that TMS was able to cure their depression (remission), not just manage the symptoms. Within the Subreddit, you can also read about experiences for patients who the treatment did not work for. Take note of the lack of aforementioned systemic side effects common to antidepressants.

Compared to Industry Rivals…

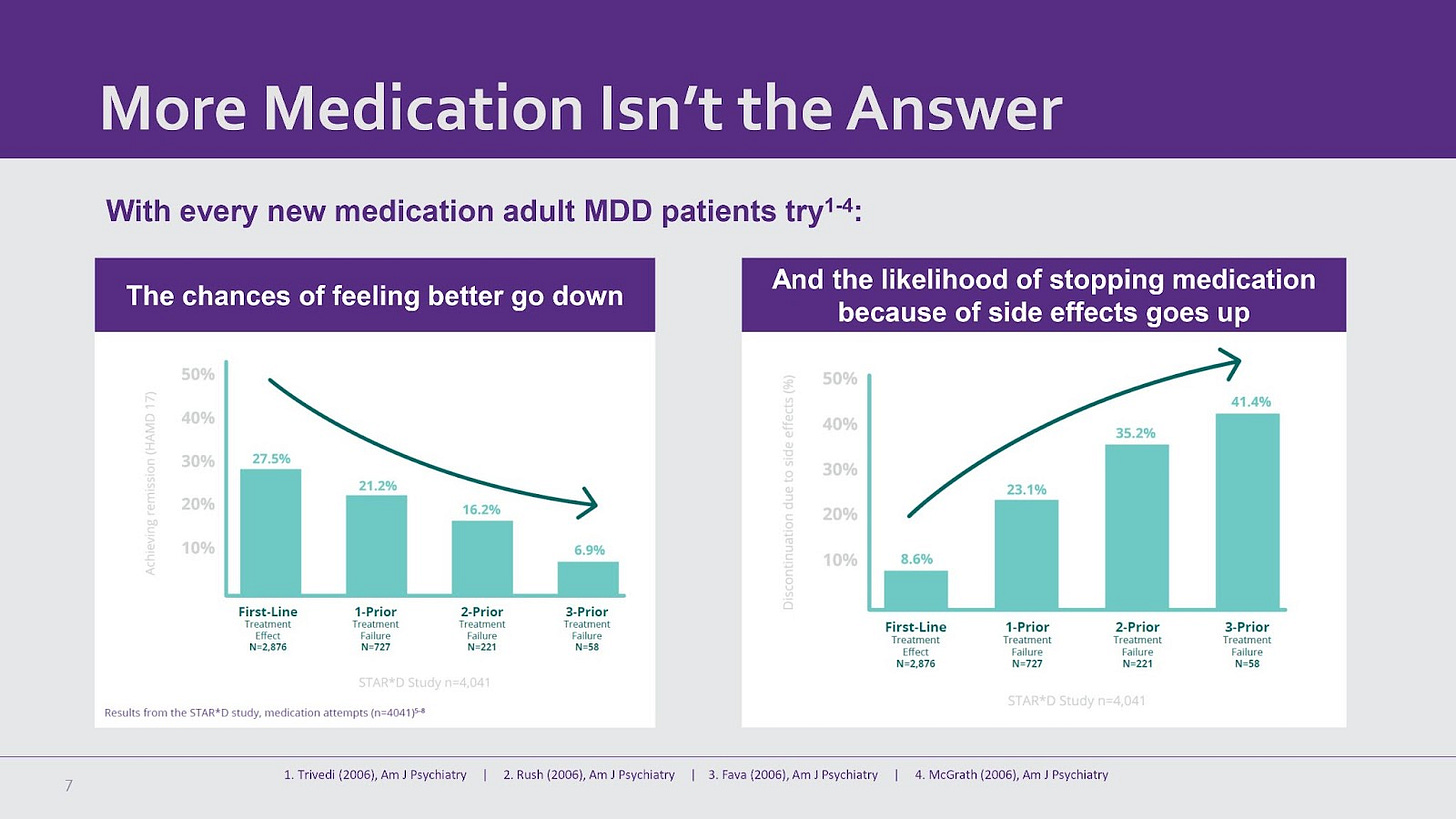

Key Advantages of NeuroStar:

FDA Clearances:

Neuronetics has a track record of pioneering additional indications for TMS. NeuroStar was the first system cleared by the FDA for MDD. In March 2024, they were the first to obtain clearance for adolescent depression, bringing their TAM to 29.3 million people in the U.S.

Update: As of March 2025, Magstim received clearance for treating adolescent depression, a full year after NeuroStar.

Clinical Evidence:

12 publications from depression registration trials, significantly outpacing competitors (BrainsWay and MagVenture have only 1 each).

Technological Differentiation:

Contact sensing and TouchStar w/Contact Sensing provide enhanced safety and efficacy, a feature not broadly available among competitors.

Offers the world’s largest MDD outcomes registry, demonstrating robust clinical data and real-world outcomes. This data is a key asset that helps NeuroStar to obtain FDA clearances.

Practice Support:

Practice consultants and marketing support position NeuroStar as a more practice-friendly option for psychiatrists. Neuronetics’ co-op marketing program alone resulted in practices experiencing 17% more treatment session utilization and 14% more new patients. Practices that completed the NeuroStar University training saw 58% more patients treated.

Tailwinds in a Windy Regulatory Environment

The current Trump Administration, with RFK Jr. as the secretary of the HHS, creates a favorable environment for TMS. RFK Jr. is a vocal critic of over-reliance on traditional pharmaceutical treatments, particularly in mental health. His opposition to pharmaceutical over-reliance could lead HHS to prioritize non-drug treatments mental health treatments like TMS.

This policy shift coincides with growing bipartisan support for expanding and improving mental health treatment. Even Senator John Fetterman, despite his opposition to RFK Jr., has emphasized mental health as a key priority.

More recently, President Trump introduced the Make America Healthy Again Commission, which aims to explore alternative treatments for mental health conditions and assess the risks associated with overuse of psychiatric medications. The Commission’s specific mandate to “assess the prevalence of and threat posed by the prescription of selective serotonin reuptake inhibitors” reflects a growing skepticism within the regulatory community. With ongoing debate among psychiatrists about the efficacy of SSRIs compared to placebo, and uncertainties about their mechanism of action, the Commission signals growing support for alternatives like TMS.

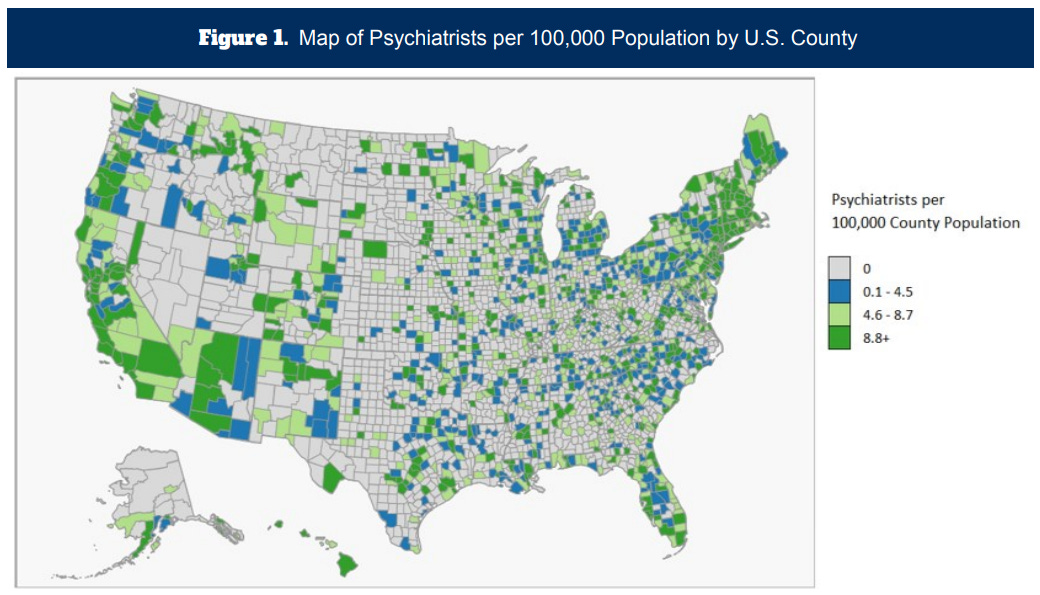

Regulatory support would also help a potential expansion of NeuroStar’s usage from psychiatrists to general practitioners. Currently, most payers require TMS to be prescribed and administered under supervision of a psychiatrist. Patients in rural areas would find it nearly impossible to access a nearby psychiatrist providing TMS treatment that is eligible for insurance reimbursement. Psychiatrists are predominantly located in urban regions, and less than half of U.S. counties have an actively practicing psychiatrist. The administration of TMS therapy involves daily sessions over several weeks, which means that patients need consistent access to treatment facilities. Expanding the approval to GPs would greatly increase the number of patients who choose TMS therapy, and there is already House Bill 152 in North Carolina working towards this.

Implications for Neuronetics:

New market approvals: HHS backing could accelerate regulatory approvals for TMS in anxiety, PTSD, chronic pain, which would greatly expand Neuronetics’ TAM.

Expanded indication: In March 2024, NeuroStar gained FDA clearance as a first-line adjunct treatment for adolescents with MDD aged 15-21. Currently, NeuroStar is approved for treatment-resistant depression for adults. If NeuroStar is assessed to be safe and effective for adolescents as a first-line treatment, a more delicate patient, it raises the probability that the FDA clears NeuroStar as a first-line treatment for adults too.

Expanded payer coverage: Patients typically must show inadequate response to a certain number of antidepressants to qualify for insurance coverage. Depending on the payer, that number used to be around 4. Over time, that number has dropped to just 1 for many payers. Also, few payers cover maintenance doses of TMS. Reimbursement of payers usually lag behind regulator approval, but strong support could push for faster policy updates.

History Doesn’t Repeat, but It Often Rhymes

To illustrate the effect of a favorable regulatory environment, consider the IHI ETF during the first Trump presidency. During 2017-2021,, IHI delivered returns of ~150%, compared to the SPX return of ~68%. Between factors such as a pro-business FDA and the repeal of the Medical Device Excise Tax, medical device stocks significantly outperformed the broader market.

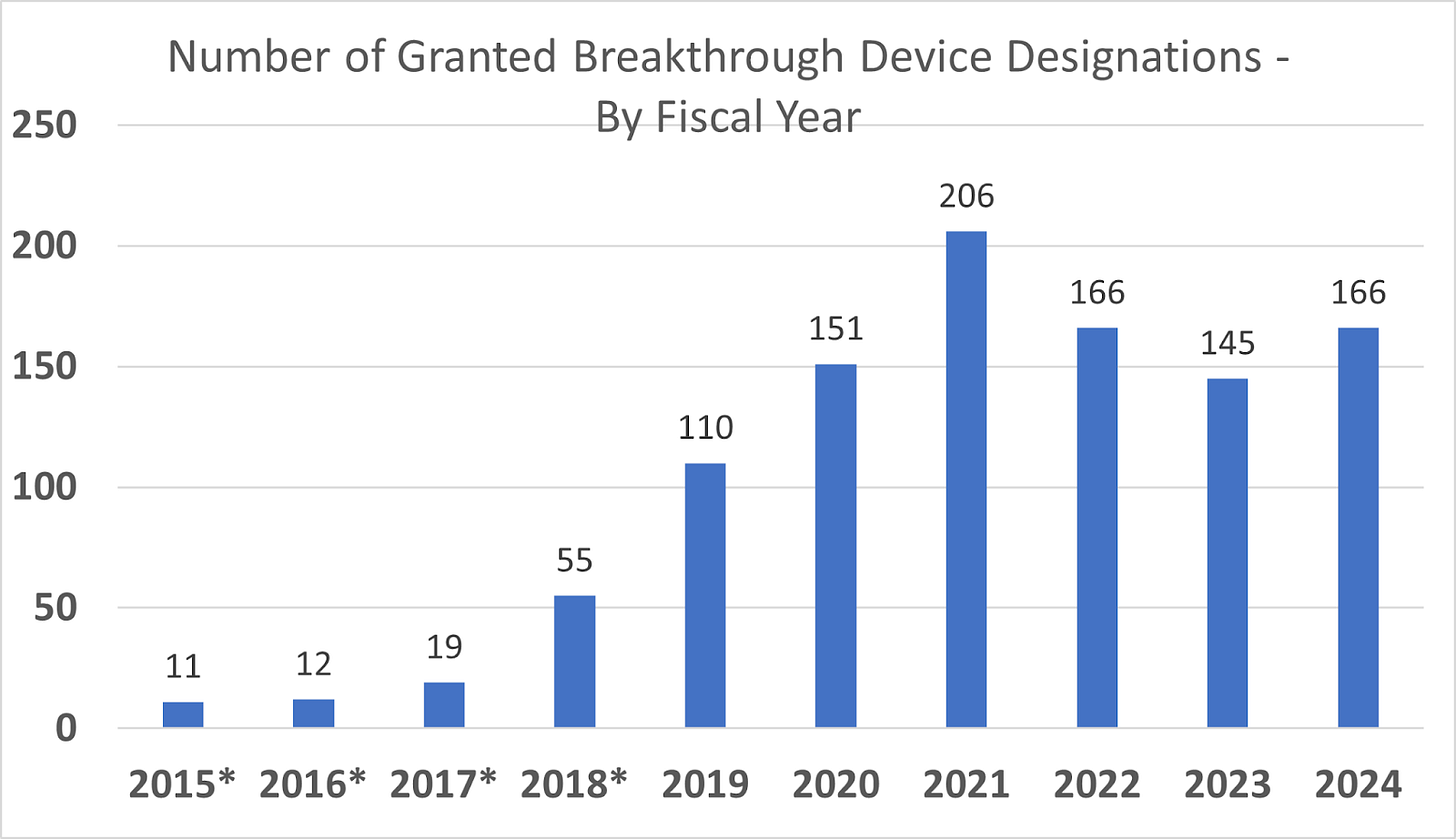

With a streamlined FDA approval process, this period saw 4 consecutive years with record breaking Breakthrough Device designations. Neuronetics was able to take advantage of the innovation-friendly approach of the FDA. They achieved the first Breakthrough Device designation for a TMS device to treat BPD. The company also took advantage of a faster and more efficient review process for 510(k) filings, earning approvals for their MT Cap, OCT MT Cap, D-Tect MT, and NeuroSite Coil Placement Accessory technology since FDA Commissioner Scott Gottlieb pushed to improve the review process.

Outdated Practice Guidelines

The American Psychiatric Association’s (APA) most recent Practice Guidelines for the Treatment of Patients with Major Depressive Disorder reads: “Evidence for TMS is currently insufficient to support its use in the initial treatment of major depressive disorder.” However, their guidelines have not been updated since 2010. Since then, a group of expert clinicians, including those from the APA’s Council on Research, have provided a consensus recommendation in favor of TMS:

Multiple randomized controlled trials and published literature have supported the safety and efficacy of rTMS antidepressant therapy.

Similarly, the American Psychological Association (yes, confusing names) does not mention TMS at all in their most recent 2019 clinical practice guidelines. They do, however, suggest acupuncture (???) as an adjunct treatment among other alternatives.

An updated guideline from the APA, reflecting the current evidence for TMS, could be another catalyst that accelerates adoption among the psychiatric community.

Looking Ahead

As awareness of TMS therapy grows, more patients will seek it out, driving demand among providers. Increased utilization leads to more clinical and real-world data, reinforcing the safety and effectiveness of TMS. This validation builds further trust with payers and patients, thus fueling even greater awareness and adoption. The result is a virtuous cycle accelerating TMS acceptance and market growth.

Neuronetics is poised for a significant growth inflection, driven by regulatory tailwinds and innovative commercialization efforts. The company has implemented an effective strategy to overcome its previous challenges with low awareness of TMS therapy.

Revision History

2025-01-24: Added more detail about TMS therapy; fixed typos

2025-01-10: Added comment on Senator Fetterman’s post on X

2025-02-12: Added P/S multiples for comparable companies

2025-02-13: Added comment on the new Make America Healthy Again Commission

2025-02-18: Updated charts

2025-02-21: Added information about North Carolina House Bill 152

2025-03-21: Restructured text for clarity